The latest market data from Kantar shows that grocery price inflation has hit its highest level in 10 years, with consumers appearing to be adjusting their shopping habits to save money.

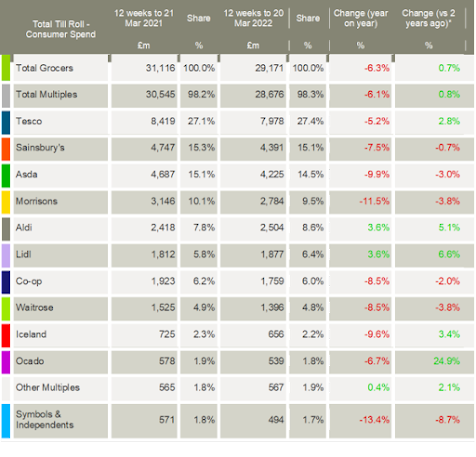

Take home grocery sales fell 6.3% over the 12 weeks to 20 March as people continued returning to eating out of the home again. Sales were still up versus two years ago, although only by 0.7% as the comparison now includes the record buying seen before the first lockdown.

“What we’re really starting to see is the switch from the pandemic being the dominant factor driving our shopping behaviour towards the growing impact of inflation, as the cost of living becomes the bigger issue on consumers’ minds,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

Over the latest four weeks, grocery price inflation reached its highest level since April 2012 at 5.2%. Prices rose fastest in markets such as savoury snacks and pet food.

McKevitt commented: “More and more we’re going to see consumers and retailers take action to manage the growing cost of grocery baskets. Consumers are increasingly turning to own-label products, which are usually cheaper than branded alternatives. Own-label sales are down in line with the wider market but the proportion of spending on them versus brands has grown to 50.6%, up from 49.9% this time last year.

“Meanwhile, the grocers are also adapting their pricing strategies in response to the rising cost of goods. One trend we’re already tracking is the move away from selling products at ‘round pound’ prices. The percentage of packs sold at either £1, £2 or £3 has dropped significantly from 18.2% last year to 15.9% this March.”

Despite Covid loosening its grip on day-to-day grocery habits, Kantar highlighted that some pandemic trends are proving stickier than others. The acceleration of online shopping over the last of years appears to have resulted in the permanent enlargement of the channel. 12.6% of sales were made online in March 2022 compared with only 8% three years ago. Shoppers over the age of 65 are leading the charge with the proportion of this demographic buying online having doubled from 9% to 18% over the past three years.

NamNews Implications:

- Actual inflation of 5.2% morphing into perceived inflation of something close to 10%…

- …in terms of the effect on shopping behaviour.

- Continued uncertainty (about most things) driving switches to own label and the discounters.

- Real issue: Aldi & Lidl now have a share of market growth window…

- …whereby they can each afford (as global retail players) to run losses in the UK…

- …for as long as it takes to increase their share of grocery as much as they want.

- (Note the ‘oldies’ buying into the convenience of online delivery, a trend that can only increase as the population ages)

No comments:

Post a Comment